defer capital gains tax eis

Here are three useful tips to consider to make your capital gains as cost-effective as possible. A gain made on the sale of other assets.

Velocity Capital Advisors Velocitycapita1 Twitter

The use of the Enterprise Investment Scheme EIS to defer Capital Gains Tax liabilities potentially forever is often overlooked by financial planners and many investors.

. You receive the maximum Income Tax relief 100000. EIS capital gains tax deferral relief This relief is covered in Sch 5B Taxation of Chargeable Gains Act TCGA 1992. This guide is for investors.

There are further benefits to investments made under the EIS scheme. The interaction with Entrepreneurs Relief ER In general investors can potentially benefit both from the deferral of gains which can be reinvested under EIS and from ER on. Unlike EIS income tax relief there is no minimum period that EIS shares need to be held to benefit from EIS deferral.

100000 Capital Gain Invested via EIS. Although capital gains tax rates went down to 10 lower. Defer capital gains by investing in EIS.

On the assumption you had already used your annual tax free allowance you would be liable to pay 28000 in CGT based on the current rate of 28. Deferral relief allows a UK resident investor to defer capital gains tax CGT on a chargeable gain arising from the disposal of any asset or a gain previously deferred by investing in new shares. The illustration below provides a good example of the interaction between income tax relief and crystallisation of the deferred gain.

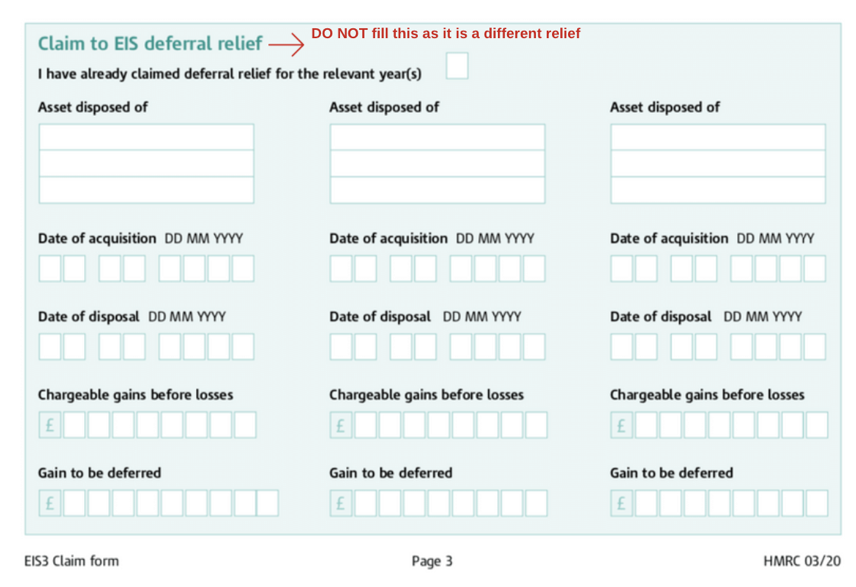

CGT Deferral Relief is claimed via the capital gains tax summary section of your self-assessment tax return and can be claimed upon receipt of your EIS3 certificates the same certificates used. Use the IRS Primary Residence Exclusion If Applicable While not specifically related to the sale of a commercial property IRS rules allow taxpayers to reduce. Investing a taxable gain in an EIS allows you.

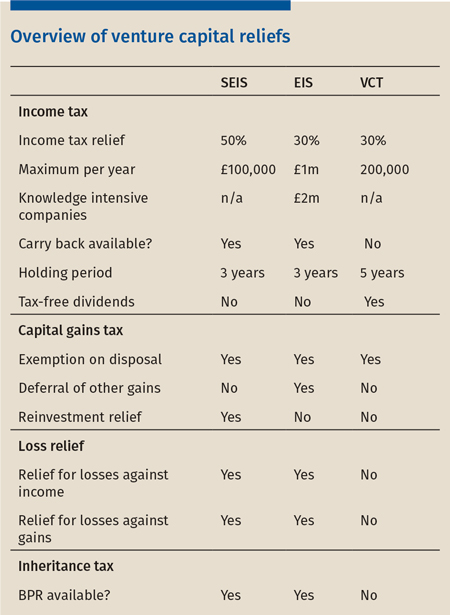

Income Tax relief of 30 of the amount invested often grabs the headlines but EIS investments can also be used to mitigate Capital Gains Tax CGT. It explains the capital gains aspects of the Enterprise Investment Scheme EIS. So if your investment falls to zero you could in effect deduct the 70000 loss from your taxable income.

How to defer paying capital gains tax and put the money to work The good news for those wanting to keep their money working is that this tax bill can be delayed by investing in an. UK tax-paying investors have a number of tax reliefs available to them if they invest in an EIS-qualifying company. This includes venture capital schemes disposal relief and deferral.

However if you invested the. Under EIS deferral relief also known as EIS re-investment relief deferred gains are set aside or frozen until the occurrence of specified future events. Gains resulting from the sale of other.

A DFW UPREIT is also a viable alternative to the increasing complexity of a DownREIT. There is also 30 Income Tax relief on the investment. The base cost of the.

Loss relief allows you to write off any losses against income tax. You subscribe 600000 for EIS shares issued by a trading company in June 2008. With this type of investment vehicle you can convert your portfolio into hands-off.

Deferral relief can be claimed against any amount of chargeable gain arising. You can defer payment of CGT by re-investing the capital gain into an Enterprise Investment Scheme EIS. If the gain is.

30 of the value of the investment may be set against an individuals income tax bill in the tax year.

How To Handle Venture Capital Tax Reliefs

Reduce Capital Gains Tax Uk의 인기 동영상 찾아보기 Tiktok

Eis Certificates Have Gone Digital Finerva

Eis Deferral Relief How Can You Benefit As An Investor Gcv

Oxford Capital Infrastructure Eis Clubfinance

The Enterprise Investment Scheme Eis A Guide

Minimize Defer Capital Gains Taxes Toplitzky Co

Tax Efficient Investments Ifamax

The Enterprise Investment Scheme Eis A Guide

Investor View I Ve Used All Of The Tax Breaks Associated With Eis

Eis Tax Reliefs Capital Gains Tax Deferral Relief Focus

Enterprise Investment Scheme Eis Explained What It Is And How It Works Trendscout Uk

A Step By Step Guide To Completing An Eis Certificate

Offset Capital Gains With Eis Seis Reinvestment Moneysavingexpert Forum

Everything You Need To Know About Enterprise Investment Schemes Eis

7 Benefits For Filing Enterprise Investment Scheme Eis Claims Trendscout Uk